What Does It Mean to Have a Negative Cash Flow

Cash menses

What is negative cash menstruum? 5 tips to manage it

As a small business organisation possessor, yous know firsthand how many obstacles y'all can face on the road to success. Ups and downs are inevitable and a critical part of whatever business that's serious about growth. Even if yous're meticulous about fiscal forecasting, things can go wrong.

Negative cash flow is among the challenges your growing pocket-size business organisation may face. Allow's say, one month, your business earns $5,000 in revenue but spends $10,000 on outgoing expenses. That's an case of negative cash flow.

Let's dive into the causes and effects of negative cash menstruation and five tips for managing it.

- What is negative cash flow?

- What causes negative cash flow?

- Effects of negative cash catamenia

- v tips to manage negative greenbacks flow

What is negative greenbacks period?

Negative cash menstruation occurs when a business spends more than it makes inside a given period. Although negative cash flow means in that location is animbalance in the revenue stream, it doesn't necessarily equate loss. Often, it reveals temporarily mismatched expenditures and income.

Negative cash catamenia is a common financial occurrence for new businesses. Starting a small business is expensive, and information technology takes time and hard work to generate cash inflows that exceed investments. In essence, dealing with negative cash catamenia is almost unavoidable.

Is negative cash menstruation bad?

Equally mentioned before, negative cash flow means that your business organisation isspending more moneythan it receives. Though negative cash flow is not inherently bad, this financial asymmetry is not sustainable or viable for your business in most cases. Ultimately, your business needs enough money to cover operating expenses. Uncontrolled or overlooked negative cash menstruation tin can render your business unprofitable.

However, the reality is that not every month turns a profit. Even the nearly well-recognized and successful corporations can struggle to stay positive every month. Some corporations may lose coin and promote negative cash flow to produce higher profits in the future. No matter the scale of your business organization, experiencing negative cash menstruation is normal.

What causes negative cash flow?

Several mistakes, miscalculations, and fiscal roadblocks tin cause you to spend more than than you earn. Allow's take a closer wait at eight of the well-nigh mutual causes of negative cash catamenia.

ane. Low profits

Your business organization's chief source of income is profit. You lot generate profits when consumers purchase your goods or services. Of grade, it cost your business money to manufacture or provide appurtenances or services. The fundamental to turning a profit is to eclipse outgoing costs with incoming acquirement. When yous can't exercise that, you feel negative cash menstruum.

In that location may be many reasons your small business concern may be struggling tokeep your rest sail positive. Those reasons can include:

- Ineffective sales and marketing strategies

- Low productivity among your staff

- Undercharging for your services or products

- Expensive operating costs

- Uncontrolled spending or cash outflow

If your business organisation'south profits are besides low—or you're altogether unprofitable—you may find it hard to source the coin to cover all your essential approachable costs. Typically, this shortcoming results in the need to borrow coin to keep operations adrift.

2. Overinvesting

I of the most mutual downfalls for businesses at any size or age is overinvesting. You overinvest when you spend an excessive amount of cash on non-business-disquisitional services, projects, or products. Ultimately, these payments only drain funds rather than boost profitability. Overinvestmentsact against your visitor'due south best interests and shareholders and tin chop-chop result in negative cash flow.

3. Expedited growth

As a small business owner, you should want togrow your enterprise. But if you don't create strategic, detailed plans for growth, you could upset your efforts. Without a detailed business organisation growth strategy, expanding too chop-chop could put your business organisation in the crimson and get out you struggling with a cash flow deficit.

Additionally, several other growth issues can impact your small business concern'south financial wellness. These problems include:

- Mismanaged or uncoordinated financial tracking

- Ineffective and unorganized business operations

- Haphazard hiring

- Losing sight of big-picture goals

4. Unexpected financial expenses

Any coin you have to spend on unexpected expenses tin can throw off yourprojected cash menses. These unexpected costs are outflows of cash you didn't forecast in your monthly or quarterly financial plan. Some of the most common unexpected expenses include insurance premiums, equipment maintenance, taxes, and shrinkage. If you lot don't classify funds to sudden charges, you lot may find yourself dealing with negative greenbacks flow.

5. Expensive overhead costs

Overhead costs account for all ongoing expenses that are not directly related to product or sales. Essentially, overhead costs are those that your business needs to stay in business—regardless of your business's profitability or success. Each of these overhead costs is disquisitional for keeping your business concern open. But if the sum of overhead expenses is too great, you may cripple your cash flow.

6. Past-due client payments

Late payments can pb to a damaging cycle of negative operating cash flow, co-ordinate to a2019 QuickBooks report. In the United States, pocket-size business owners reported an 81% increment in outstanding receivables from 2018 to 2019. Pocket-sized businesses held an boilerplate of $78,355 in outstanding receivables. 71% of respondents claimed that late payments affected their ability to encompass supplier payments. Without setting and enforcing detailed payment terms, small business owners may find themselves scrambling to collect unpaid invoices. Without those payments, they may not take enough cash to proceed their businesses afloat.

7. As well loftier or too low production pricing

The price of your goods and services tin can influence your cash menses and net profit greatly. If you lot're not charging enough or charging too much, any imbalance tin atomic number 82 to low profit margins.

As you make up one's mind your ideal market prices, you lot'll confront two truths: If your prices are as well high, consumers may non purchase your products. If your prices are too low, you may not generate the profit you demand to proceed your business alive and thriving.

8. Poor financial planning

If you don't regularly assess your cash catamenia statements,strategize a greenbacks flow forecast, or set up a realistic budget, your business organization may experience greenbacks shortages. Financial planning is a critical facet of any business that has its sights on growth. Without the proper game plan, your finances can fall off-kilter and effect in negative cash flow.

Effects of negative cash catamenia

Every bit a business owner,cash flow management should be as critical and profound as revenue and profit supervision. Several negative consequences come along with negative greenbacks flow. If you lot don't take them seriously or mediate them, negative cash flow can threaten and jeopardize your business's success and sustainability.

Among these many ramifications, stunted business growth, stymied dividends, and promotional deficiencies gear up your visitor dorsum most.

Stunted growth

If your modest business concern spends more fourth dimensionmanaging negative cash flow, it tin can't fully shift its focus back to growth and bigger challenges. Fifty-fifty if yous can embrace your overhead costs, insufficient cash inflows pose an inevitable roadblock in your company's progress. With a smaller upkeep, achieving growth goals can go insurmountable. Stunted business growth can also lead to diminished employee morale and a tarnished visitor reputation.

Stymied dividends

Without positive cash flow, your business organisation may struggle to pay dividends to owners. Anyone who has invested in your visitor may not collect areturn on their investment, dissentious your human relationship. Limited dividends in exchange for growth and further investment is tolerable. Butinvestors may take issue with a company that struggles due to poor greenbacks flow direction.

Promotional deficiencies

It's common for minor businesses to cutting their marketing budgets to reduce their overall operating expenses. But reducing marketing efforts can lead to more advertising sales and discounts that tin can tarnish customer perception of your brand and business viability.

If concessions on your products or services become abiding, consumers may look those lower prices. Or worse, they may lose interest when yousget your concern back to positive. This shift in expectations can take negative long-term effects on your revenue potential.

5 tips to manage negative cash catamenia

Finally, the golden question: How tin can yous manage negative cash menstruation? Apply these five tips to get your cash menstruum back into the dark-green.

1. Be mindful of your spending and investing

Before splurging on new equipment, software, or employees, counterbalance your business's needs and review your financial statements. Upon review, make key changes to your spending and investing activities. One of the easiest ways to determine your wants from your needs is by creating a list that separates "must-haves" from "would-likes."

When you lot're dealing with negative cash flow, spending money on would-likes works against your business's best interest. It's more of import to spend working capital on software, projects, or equipment that tin can keep your business open and whip your cash flow into shape.

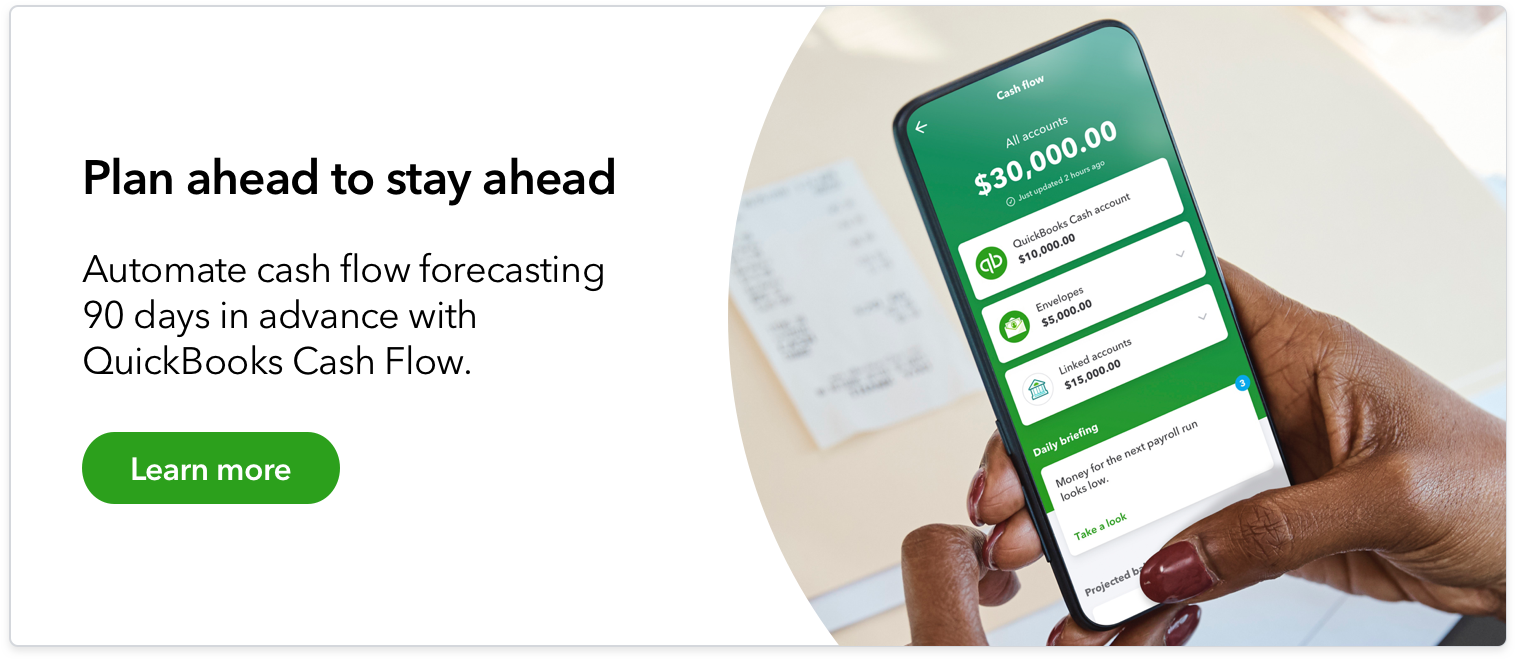

2. Create a cash flow statement and forecast regularly

Cash menses measures all expenses that go in and out of your business within a specified flow.

Matched fluctuation in revenue and operating expenses mark healthy cash flow. The just style to achieve healthy cash flow is byimplementing and regularly operating with a cash flow forecast.

To create better projections, examine your current cash flow past creating a greenbacks menstruation statement (or statement of cash flows).

A cash menstruation statement shows how shifts in remainder sheet accounts and income touch on cash and greenbacks equivalents. The Small-scale Business concern Assistants (SBA) recommends performing a greenbacks flow assay monthly. This analysis tin can aid ensure your small business has plenty incoming cash to handle the next month's obligations.

Cash menstruation forecasts are similar to ordinary business concern budget plans. Forecasts should narrowly gauge all business organization income and operating expenses on a monthly or quarterly footing.

When done effectively, your cash flow forecast should help give you a better moving picture of your working capital and expectations. Forecasting can also help you determine future financing activities and examine which expenses yous can afford.

3. Review outgoing expenses regularly

If you don't actively monitor outgoing expenses, you may find information technology hard to gain full business spending insights. When you review your outgoing costs proactively, you can maintain a stronger grasp on your finances and prevent future fiscal issues.

To begin this review procedure, tape all overhead costs. Assess the costs that are absolutely necessary and determine which you could swap for a more affordable alternative. Do the aforementioned with operating expenses.

Run through this process every month or every quarter to ensure y'all're on tiptop of your business'south financial health.

iv. Reduce expenses

Many businesses struggle with negative cash menstruum due to an overabundance of operating expenses. After reviewing outgoing expenses, assess where you may be able to eliminate unnecessary overhead and operating expenses.

Of class, there are many regular operating activities essential to your business's survival. And so it's important to exist intentional when cutting costs. Cutting costs can efficiently liberate your business from negative cash flow, just cut costs haphazardly can lead to further injury.

Explore new ways to run your business concern with fewer expenses by creating greenbacks catamenia forecasts that account for whatsoever fiscal shifts.

v. Create an emergency budget to accommodate unexpected expenses

Unexpected operating expenses can upturn your finances instantly. That's why it's and so of import to reserve enough greenbacks to cover whatsoever sudden costs. If yous're already working with a slim upkeep, consider cutting down on unnecessary outflows of cash that you could allocate to anemergency upkeep.

For example, if y'all have a monthly software subscription that y'all no longer use, cancel it. If you have an expensive utility neb, consider more economical free energy alternatives. The idea is to eliminate anything that isn't necessary for your business success so that you can reserve more money for emergencies.

Wrapping upward

Negative cash flow is a common facet of business organization growth and development, no matter your company's size or calibration. So long as you're quick to recognize and remedy your cash flow imbalance, negative cash menses is nothing to worry about. Follow this guide to stay on the pathway toward success.

Recommended for you lot

accounting

Gratis business budget templates (PDF/Excel) + how to create

Fri Jan 07 2022

payments

How to speed up payments: xx tips to get clients to pay their bills and invoices faster

Mon Apr 05 2021

Cash flow

Cash catamenia issues? Here'southward how to bounce back to cash menstruum positive

Monday Aug 17 2020

Looking for something else?

Get QuickBooks

Smart features made for your business. We've got you lot covered.

Firm of the Hereafter

Proficient communication and resources for today'due south accounting professionals.

QuickBooks Support

Get assist with QuickBooks. Find manufactures, video tutorials, and more.

Source: https://quickbooks.intuit.com/r/cash-flow/negative-cash-flow/

Post a Comment for "What Does It Mean to Have a Negative Cash Flow"